Nvidia Closes In on 5 Trillion USD Milestone as AI Demand Soars

By Global Leaders Insights Team | Oct 30, 2025

Nvidia is about to make history. The chipmaker is on track to become the first company ever to hit a $5 trillion market value, driven by huge demand for its artificial intelligence technology.

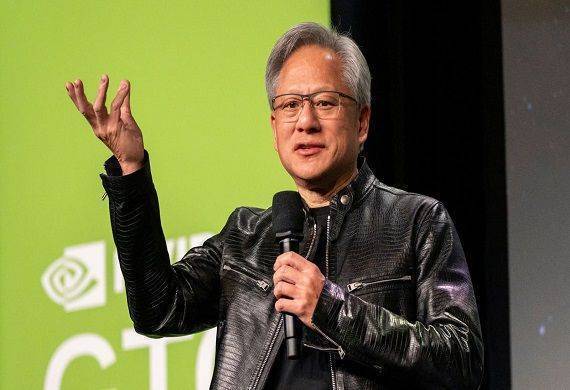

The company’s stock jumped more than 3% before the market opened on Wednesday. The surge came after CEO Jensen Huang announced $500 billion in orders for AI chips and plans to build seven powerful supercomputers for the U.S. government.

Once known mainly for graphics cards used in gaming, Nvidia has become the backbone of the global AI boom. It has passed Apple, Microsoft, and Google’s parent company Alphabet in market value. A $5 trillion valuation would be larger than the entire cryptocurrency market and equal to half the worth of Europe’s top 600 companies.

- Nvidia set to become first $5 trillion company amid AI supercycle

- Jensen Huang reveals $500B AI chip orders as Nvidia races past rivals

- Nvidia reached $4 trillion just three months ago—an astonishing pace of growth.

Nvidia nears $5 trillion valuation as AI chip demand hits record highs. “Pretty much everything has gone right for them in the last day,” said Michael Brown, a market analyst at Pepperstone.

Huang used a developer conference to highlight Nvidia’s role in U.S. tech strategy. He praised President Trump’s focus on American innovation but warned that cutting China out of Nvidia’s network could hurt U.S. progress, since half the world’s AI talent is there.

The company’s advanced chips power major AI systems, including ChatGPT and Elon Musk’s xAI. While competitors like AMD are trying to catch up, Nvidia remains the go-to choice.

Also Read: Trump & Xi Jinping Meet in Busan Amid Trade, Nuclear Tensions

Investors are betting big on continued AI spending, though some worry the stock is overvalued. Nvidia carries heavy weight in major indexes like the S&P 500, meaning its moves affect the broader market. The company reports earnings on November 19.

.jpg)