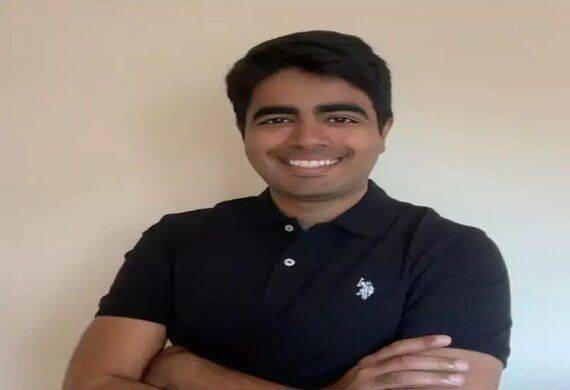

Ex-Y Combinator Investor Arnav Sahu Joins Peak XV as First Indian Partner

By Global Leaders Insights Team | Jun 21, 2025

- Former Y Combinator principal Arnav Sahu joins Peak XV as its first U.S.-based investment partner.

- He'll focus on AI and growth-stage startups in San Francisco, aligning with Peak XV's US expansion.

Arnav Sahu, who previously worked as a principal at startup accelerator Y Combinator for four years, has joined Peak XV as its first investment partner.

Sahu confirmed the news on X (formerly Twitter), saying he has joined Peak XV in the Bay Area, California, as a partner. "YC altered my life trajectory. The past few weeks at Peak XV have been both enjoyable and intense. We've invested in a few special YC startups in San Francisco and around the world. Much more to come."

Sahu previously worked at Y Combinator, where he was involved in growth investing from seed funding to Series D. According to his LinkedIn profile, he has invested in companies such as ScaleAI, Replicate, Zepto, Luminai, Vanta, and Rippling, among others.

In his new role, Sahu will make investments as part of a new San Francisco-based team. Peak XV has been attempting to establish itself as a separate entity since 2023, following the Sequoia spin-off.

The move is consistent with a significant push to establish itself in the United States, where it was unable to compete for deals due to its franchise partnership with Sequoia, as reported in April.

In a 12-year career, Sahu has led investments at Y Combinator's Continuity Fund, Spark Capital, and Blackstone. He also founded Wolfia, an AI-search startup, and managed projects for App Dynamics and Cisco.

Peak XV Partners made headlines in April when it announced plans to launch its first independent fund with a target corpus of $1.2-1.4 billion. The top deck restructuring is an effort to make deals in the thriving AI sector and help its startups collaborate in the United States.

Also Read: Trump's National Guard Use in California Faces Legal Test

Since 2006, the venture capital firm, which has backed new-age companies like Razorpay, Oyo, and Truecaller, as well as traditional businesses like Prataap Snacks, Five Star Business Finance, and Indigo Paints, has generated nearly $6 billion in cash through exits from both public and private markets.

.jpg)