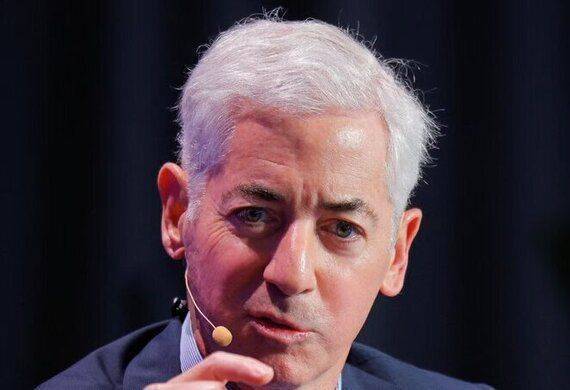

Bill Ackman Unveils $300 Bn Reform Plan for Fannie and Freddie

By Global Leaders Insights Team | Nov 20, 2025

Billionaire hedge-fund manager Bill Ackman has unveiled a sweeping proposal to reform the U.S. mortgage giants Fannie Mae and Freddie Mac, outlining a strategy he believes could unlock nearly $300 billion in value for American taxpayers. Ackman, whose fund Pershing Square has held long-term positions in the two companies, argues that the time has come for the government to resolve their conservatorship and restore them to full financial independence.

Key Highlights

- Bill Ackman proposes comprehensive three-step reforms to stabilize, modernize, and strengthen Fannie Mae and Freddie Mac.

- The $300 billion plan aims to boost mortgage market resilience while protecting taxpayers and ensuring long-term safety.

His plan is built on three major steps.

First, Ackman wants the U.S. Treasury and the Federal Housing Finance Agency (FHFA) to formally acknowledge that both companies have already repaid — and, in fact, far exceeded — the amount they received during the 2008 financial crisis bailout. He maintains that continuing to treat them as if they still owe money is financially unjustified.

Second, he proposes that the Treasury exercise its warrants for 79.9% ownership in the firms. This move, he argues, would convert the government’s position into common equity, giving taxpayers a large ownership stake and crystallizing massive financial benefits.

Third, Ackman recommends returning Fannie Mae and Freddie Mac to the New York Stock Exchange, asserting that their capital levels, earnings power, and balance-sheet strength now satisfy the criteria for a public listing.

Also Read: Trump to Meet NYC Mayor-Elect Zohran Mamdani at White House

He further suggests recalibrating the capital requirement to around 2.5%, claiming that excessively high capital standards limit the companies’ efficiency without meaningfully reducing systemic risk. According to Ackman, implementing these reforms would not only create long-term stability in the U.S. housing-finance system but also deliver a “high-value, low-risk” outcome for taxpayers, making the entire restructuring a potential generational opportunity.

.jpg)