Nvidia CEO’s $500 Bn Forecast Sets Tone for Q3 Results

By Global Leaders Insights Team | Nov 18, 2025

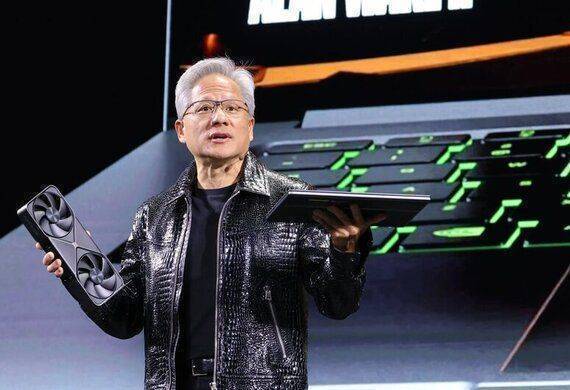

The company's Q3 2025 earnings announcement, scheduled for November 19, will center around Nvidia CEO Jensen Huang's audacious disclosure of a $500 billion chip order spanning 2025 and 2026.

Despite major obstacles from US export restrictions on sales to China, a once-critical market that accounts for up to 25% of Nvidia's data-center income, this unprecedented figure illustrates the tremendous demand for AI accelerators and places Nvidia as a frontrunner in the global AI race.

Key Highlights

- Nvidia CEO predicts a $500 billion order pipeline for upcoming Blackwell and Rubin AI chips.

- Despite geopolitical headwinds and U.S.-China export restrictions, demand from hyperscalers remains exceptionally strong.

Nvidia's unprecedented order book

Jensen Huang revealed the enormous "visibility into" $500 billion combined order queue, mostly for its flagship Blackwell and Rubin GPUs and connected AI networking equipment, during his speech at Nvidia's GTC conference in Washington in October.

Three months after reaching $4 trillion, Nvidia's market capitalization surpassed all previous records, reaching $5 trillion by October 2025. Nvidia's dominance in the AI boom is shown by this almost unprecedented visibility into future income.

According to reports, Nvidia stock is currently trading over 5% below the level on the day of announcement, despite Huang's optimistic order projection on October 28.

This decline is a reflection of the ongoing discussion among investors regarding the durability of the AI boom, especially the worries that only a few number of hyperscalers—large cloud companies—are now driving significant infrastructure spending. Nvidia's generally positive outlook is clouded by this doubt as its Q3 earnings draw near.

Nvidia's market share in China's AI GPU market has virtually disappeared due to US export restrictions, falling from 95% to nil. This has resulted in an estimated yearly revenue loss of the low tens of billions. Nvidia is compelled by these limitations to intensify its efforts at diversification and concentrate on other international markets.

However, Nvidia's optimistic prognosis is supported by the unquenchable demand for AI gear in data centers, which is fueled by hyperscalers like Microsoft and Amazon.

After Jensen Huang's announcement, stocks responded favorably. However, worries about supply chain bottlenecks, geopolitical tensions, and the sustainability of growth rates have created a mixed mood in the market.

Also Read: CEO Jensen Huang’s Wealth Surges as Nvidia Hits $5T Valuation

Analysts predict that Nvidia will post Q3 revenue of about $54.8 billion, up 56% from the previous year, and earnings per share of $1.25. The company's forecast for Q4 revenues of about $61.9 billion suggests a possible acceleration.

.jpg)