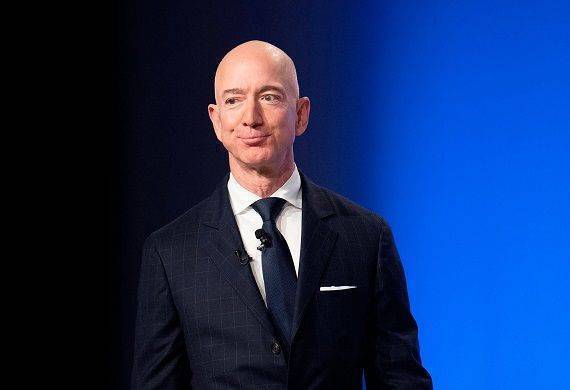

Jeff Bezos Sells 1.5 Billion USD in Amazon Shares Through Preplanned Strategy

By Global Leaders Insights Team | Jul 28, 2025

Jeff Bezos, the founder of Amazon, recently sold 6.6 million shares of the company, worth about $1.5 billion, according to a filing with the U.S. Securities and Exchange Commission (SEC).

The sales took place on July 21 and 22, 2025, just before Amazon’s second-quarter earnings report on July 31.

These transactions were part of a prearranged Rule 10b5-1 trading plan, which lets company insiders schedule stock sales ahead of time to avoid any suspicion of trading on insider information.

Since late June, Jeff Bezos has sold nearly $5.7 billion worth of Amazon stock, following a structured plan. Reports indicate he may sell up to 25 million shares by May 29, 2026, under the same plan, which follows SEC guidelines.

- Jeff Bezos Sells $1.5 Billion in Amazon Stock Ahead of Q2 Earnings Report

- Bezos Cashes Out More Amazon Shares, Invests in Blue Origin and Philanthropy

- Jeff Bezos’ Amazon Stake Shrinks, But He Remains Second-Richest in the World

The Rule 10b5-1 plan, established under the Securities Exchange Act of 1934, ensures that trades are set up in advance, before insiders might have access to sensitive company information. Over the years, Bezos has sold more than $50 billion in Amazon stock since 2002, including $18.2 billion in 2024 and 2025.

Even after these sales, Bezos remains Amazon’s biggest individual shareholder, with around 900 million shares worth over $200 billion. The sales come as Amazon’s stock has climbed 38% since April, fueled by excitement over its artificial intelligence and cloud computing efforts. Analysts predict Amazon will report $1.32 per share on $162 billion in revenue for Q2, though its growth lags behind competitors like Meta and Nvidia.

Also Read: US and EU Secure Trade Deal, Avoiding Tariff War

Bezos’ recent financial moves follow his lavish $50 million wedding to Lauren Sanchez in Venice. He’s also been funding projects like Blue Origin, his space exploration company, and the Day One Fund, which supports education and homelessness initiatives, partly through stock sales and donations. Market watchers see these sales as part of Bezos’ regular financial planning, not a sign of worry about Amazon’s future.

.jpg)